Online Privacy, Ad Blockers, and the Rise of Piracy: A Triple Threat to Streaming Stocks?

The digital landscape is shifting—and not quietly. Between mounting privacy concerns, a landmark German court ruling on ad blockers, and a resurgence in piracy, streaming giants like Netflix (NFLX), Disney (DIS), and Comcast (CMCSA) face a perfect storm that could reshape their financial futures.

The German Ad Blocker Ruling: A Legal Precedent with Global Ripples

On July 31, 2025, Germany’s Federal Court of Justice (BGH) overturned a previous ruling that had protected ad blocking software from copyright claims. The case, brought by Axel Springer SE against Adblock Plus developer Eyeo GmbH, now returns to the Hamburg court for reconsideration.

At stake is whether modifying website code via ad blockers constitutes a violation of copyright law. If upheld, this could set a precedent that empowers publishers to restrict ad blockers—potentially influencing browser architecture, user rights, and digital advertising models across Europe and beyond.

Online Privacy vs. Monetization: A Growing Tension

Consumers are increasingly demanding control over their digital environments. Privacy-enhancing tools like ad blockers, VPNs, and anti-tracking extensions are no longer niche—they’re mainstream. Yet, these tools directly challenge the ad-driven revenue models of streaming platforms and publishers.

In the U.S., this tension is compounded by the FBI’s 2022 guidance recommending ad blockers to protect against malicious ads. If European courts begin to restrict ad blockers, U.S. regulators and tech companies may face pressure to clarify their stance—potentially leading to new legislation or browser-level changes.

Piracy’s Comeback: A Symptom of Subscription Fatigue

Streaming services have become victims of their own success. With subscription costs rising sharply—Netflix’s ad-free plan jumped from $9.99 to $15.49, and Disney+ from $7.99 to $11.99—many users are turning back to piracy.

- U.S. households now spend nearly $1,000/year on streaming subscriptions

- Visits to illegal streaming sites rose 9% in 2022, with some platforms drawing more traffic than legitimate services

- Piracy operations generate $2 billion/year, with margins nearing 90%

This trend signals a breaking point. Consumers feel maxed out—financially and emotionally—and are seeking alternatives that offer simplicity, affordability, and control.

Implications for Stock Prices

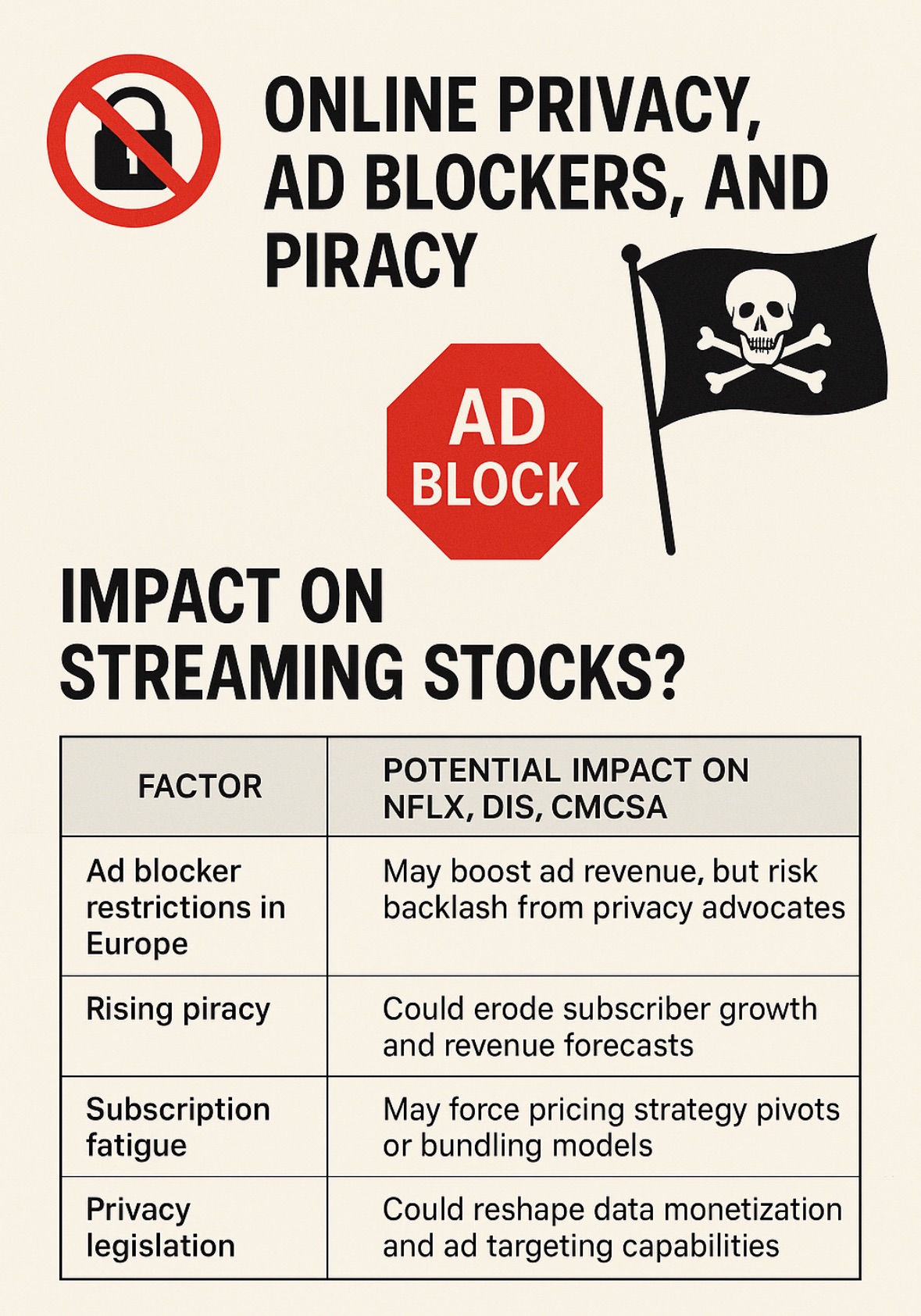

| Factor | Potential Impact on NFLX, DIS, CMCSA |

|---|---|

| Ad blocker restrictions in Europe | May boost ad revenue, but risk backlash from privacy advocates |

| Rising piracy | Could erode subscriber growth and revenue forecasts |

| Subscription fatigue | May force pricing strategy pivots or bundling models |

| Privacy legislation | Could reshape data monetization and ad targeting capabilities |

What Can Be Done in the U.S.?

As a Public Affairs Specialist, you’re uniquely positioned to advocate for balanced solutions. Here are some internal strategies and external actions to consider:

- Audit digital communications for compliance with evolving privacy norms

- Engage with browser developers to understand future ad blocker integrations

- Monitor legal developments in Europe for potential U.S. spillover effects

External Advocacy:

- Support consumer education on privacy tools and responsible streaming

- Collaborate with industry groups to shape fair-use standards for ad blockers

- Encourage bundling models that reduce subscription fatigue and piracy incentives

If you found this analysis helpful, consider subscribing to our newsletter for more insights on digital policy, media trends, and stock market implications.